Erzengel

|-o-| (-o-) |-o-|

- Joined

- Sep 28, 2004

- Messages

- 75,816

- Reaction score

- 5,064

- Points

- 203

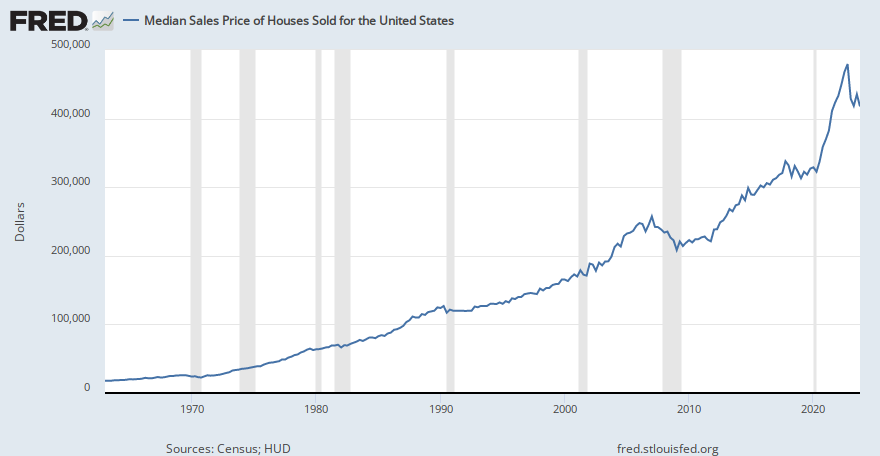

If you purchased a house even 15 years ago, I'm sure it's 60-70% more than when you purchased it now.

So unless you downsize, any profit you'd make towards the house would just go towards a lateral purchase of something equatable to what you had previously had. Unless you moved from a densely populated area to a less densely populated area.

I passed some new multifamily units which are listed as "luxury rentals" in town that's off mass transit in my state. For a 2 bedroom, 2 bath unit, it's essentially $3k a month.

So unless you downsize, any profit you'd make towards the house would just go towards a lateral purchase of something equatable to what you had previously had. Unless you moved from a densely populated area to a less densely populated area.

I passed some new multifamily units which are listed as "luxury rentals" in town that's off mass transit in my state. For a 2 bedroom, 2 bath unit, it's essentially $3k a month.