MagnarTheGreat

Web Ninja

- Joined

- Jul 8, 2011

- Messages

- 37,596

- Reaction score

- 21,173

- Points

- 103

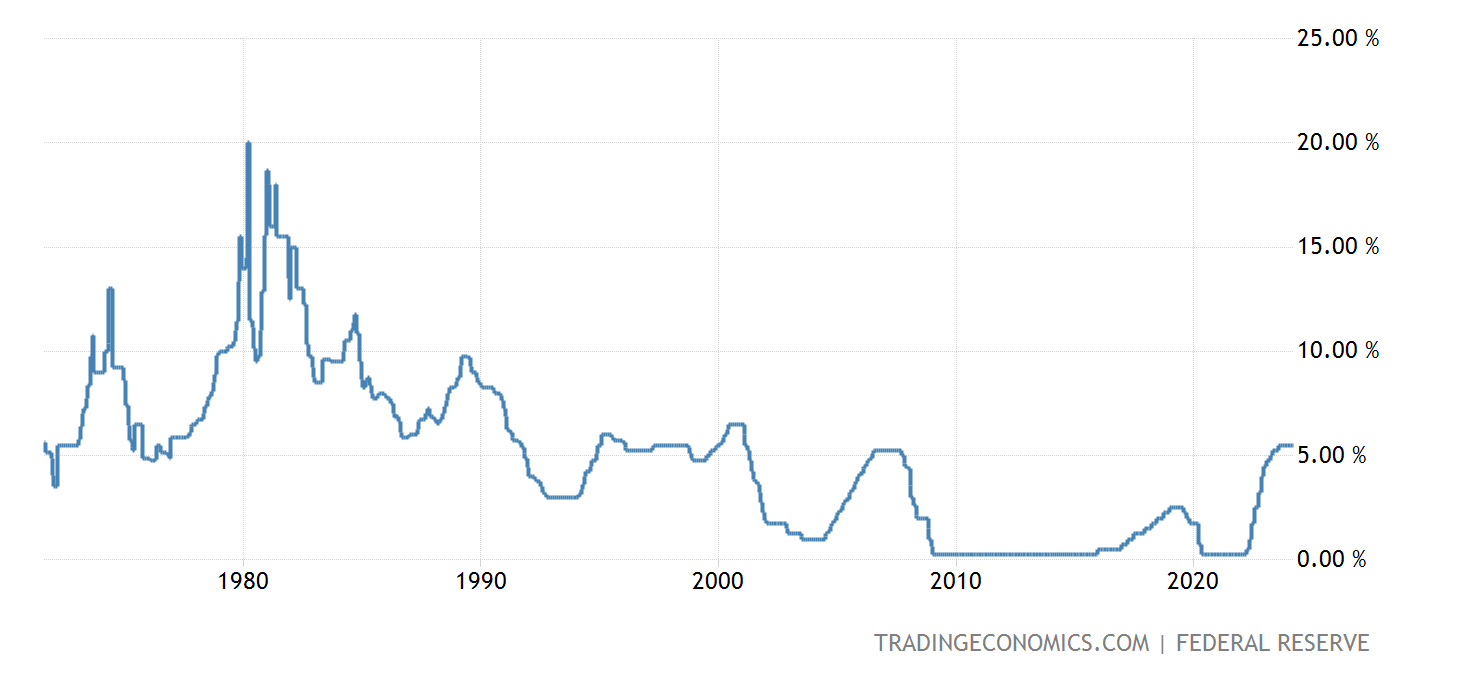

Consumer Price Index Summary - 2022 M11 Results

YoY rate down to December 2021 level.

United States Inflation Rate - November 2022 Data - 1914-2021 Historical

Heatmap - Economic Indicators By Country

YoY rate down to December 2021 level.

United States Inflation Rate - November 2022 Data - 1914-2021 Historical

Heatmap - Economic Indicators By Country